Introduction

The Tax ID System has been developed to provide a secure and centralized repository for linking University Issue Numbers (UIN) to Social Security Numbers (SSN), Individual Taxpayer Identification Numbers (ITIN), Federal Employer Identification Numbers (FEIN), and other identifiers used by internal and external business partners. The system can also accommodate storage of unofficial identifiers for specific business purposes, such as National Student Loan Database System identifiers or student numbers. No other personal information about individuals, such as name, address or birth date, is stored on the Tax ID System.

This system is a response to the University of Texas System's Business Procedures Memorandum 66 issued in 2004 to serve as a guideline for the protection of the confidentiality of social security numbers. Specifically, the Tax ID System provides a means to limit access to social security numbers only to those services which have a demonstrated business purpose for their use.

The Tax ID System consists of four web pages:

- Self-Reporting Tax ID page — The Self-Reporting web page gives entities the ability to report their Tax ID number to the University.

- View All Tax ID page — The View All Tax ID page displays all records for a specified UT EID or Tax ID number.

- Master Look Up Tax ID page — The Master Look Up page displays only the master record for a specified UT EID or Tax ID number.

- Subsystem Admin page — The Subsystem Admin page gives subsystem administrators the ability to update, add, and delete subsystem records.

Authorization

Each web page of the Tax ID System, except for the Self-Reporting Tax ID page, has a separate authorization level that is maintained in Apollo. Authorization to use the Self-Reporting Tax ID page is not restricted. Because the Tax ID System is owned by UT Austin, other UT institutions can have subsystems but only the UT Austin contact can update their authorizations. Each University of Texas institution web page also has separate Apollo authorization levels. Contact XXX to request authorization.

Verification Levels

Each Tax ID that has been reported receives a verification level. The verification level indicates the degree of confidence the University has in the quality of the Tax ID. Higher verification levels indicate a higher degree of certainty that the Tax ID is valid. These levels also determine which record will become the master record.

Verification Level |

Description |

| 000 |

Unverified (for use on inactive records) |

| 100 |

Autogenerated |

| 150 |

Rejected by Social Security Administration, Financial Services Office |

| 200 |

Provided by UIN owner through self-reporting web site |

| 250 |

Provided by UT staff or department |

| 300 |

Imported from a UT information system |

| 320 |

Self reported through the Financial Aid Office |

| 350 |

Official temporary SSN issued by the Payroll Office |

| 400 |

Verified by UIN owner matching another source |

| 450 |

Tax ID obtained from the Payroll Office |

| 500 |

Image of card obtained, original card not presented |

| 600 |

Matched to NSLDS database |

| 700 |

Card presented and inspected |

| 750 |

FEIN matches DUN & Bradstreet records |

| 760 |

Matches SSA records through the Financial Aid Office |

| 800 |

SSN matches Social Security Administration Records, Accounting Office |

Record Type

The Tax ID System is comprised of a collection of entity records. Every record within the Tax ID System must have a Tax ID assigned to it and must be sponsored by a University department (example: Scholarships, Payroll, etc.). If a valid Tax ID cannot be obtained, a Generated ID (G) will be assigned to the record. There are two types of records:

- Subsystem Record — Business areas authorized to store and maintain Tax ID's are called subsystems. Multiple records can exist for the same entity because different subsystems may need to store their own version of the information or record. The term subsystem record refers to those records that exist on the system, but do not have the highest available verification level and therefore, are not linked to the UIN. Each subsystem is responsible for the quality of the subsystem records, and when conflicts in the data arise, must work to resolve them.

- Master Record — The master record reflects the best quality record and the highest verification level available. The master record is the Tax ID that is linked to the UIN and can not be deleted.

Tax ID Types

Subsystems can store different types of tax identifiers based on the business needs of their areas. The Tax ID type has two purposes:

- It documents the type of tax identifier being stored.

- It differentiates official Tax ID types from unofficial types.

Official Tax ID Types |

| Type |

Description |

| S |

Social Security Number (SSN) |

| F |

Federal Employer Identification Number (FEIN) |

| I |

Individual Taxpayer Identification Number (ITIN) |

Unofficial Tax ID Types |

| Type |

Description |

| C |

Centralized Receivable Entity ID |

| D |

SSN Delay Number - Official Temporary SSN from either the Payroll Office or Scholarships |

| G |

Generated Number |

| N |

National Student Loan Database Number |

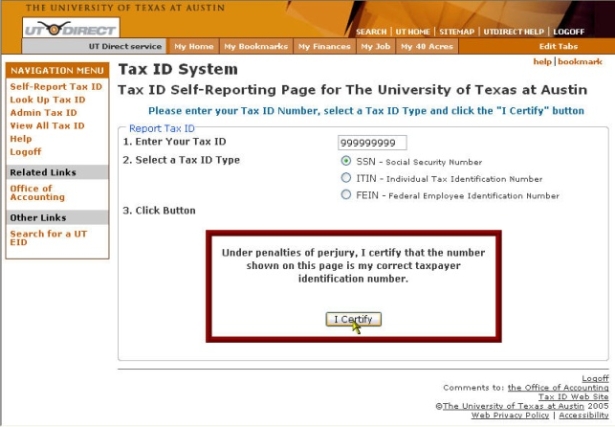

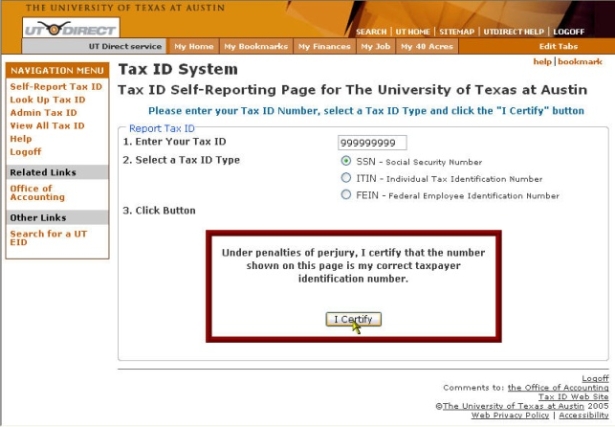

Self-Reporting Tax ID page

The Self-Reporting web page gives entities the ability to report their Tax ID number to the University. Authorization to use this page is not restricted. Entities must enter their Tax ID number, Tax ID type, and certify the number entered is the correct taxpayer identification number by pressing the I Certify button.

Entities must then re-enter their Tax ID number and click the Confirm button.

- If the number entered does not exist in the Tax ID System, a new record with a verification level of 200 will be added to the system and a success message will be displayed.

- If the number entered matches a pre-existing record in the Tax ID System, a new record will not be created and a message indicating that the record matches ours will be displayed.

- If the number entered does not match the existing record in the Tax ID System, a new record will not be created and a message instructing the users where to go to change their Tax ID will be displayed.

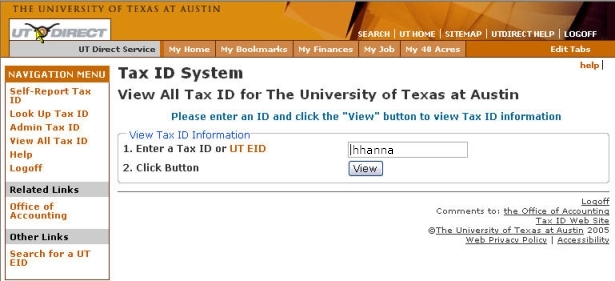

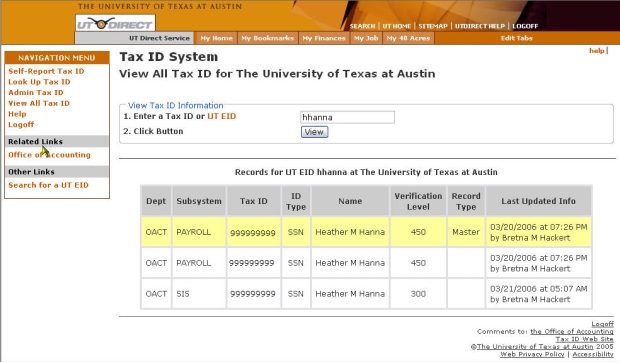

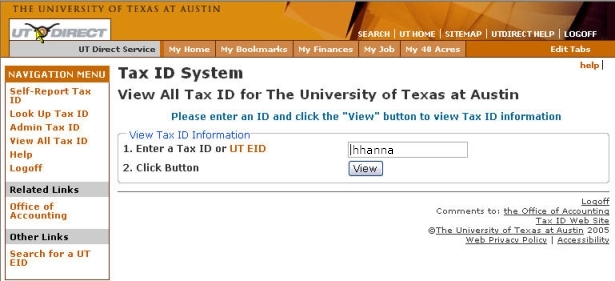

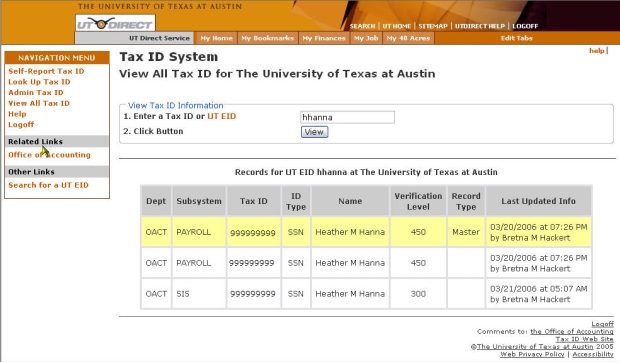

View All Tax ID page

The View All Tax ID page displays all records for a specified UT EID or Tax ID number. Authorized users can enter either the Tax ID number, UT EID, or UIN for an entity and click the View button.

Information for corresponding identifiers for the UT EID, Tax ID or UIN will be displayed. The Master record will always be displayed in yellow.

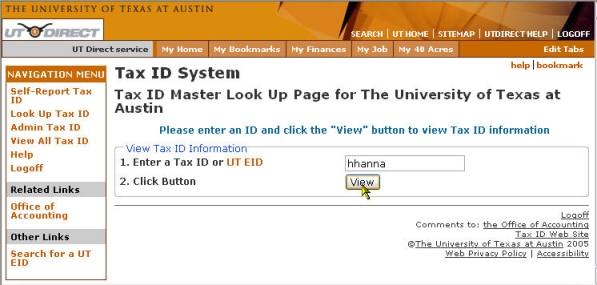

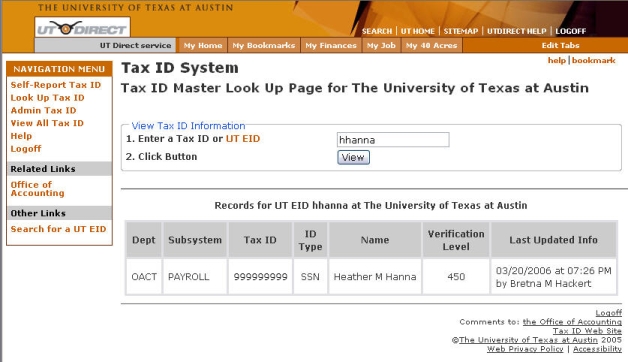

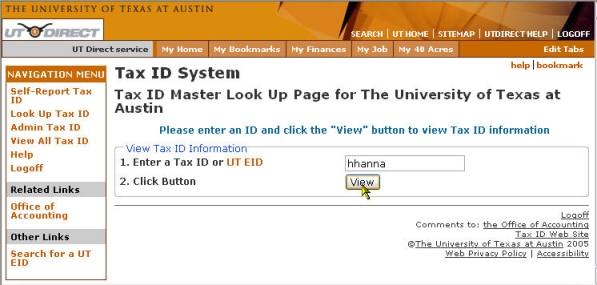

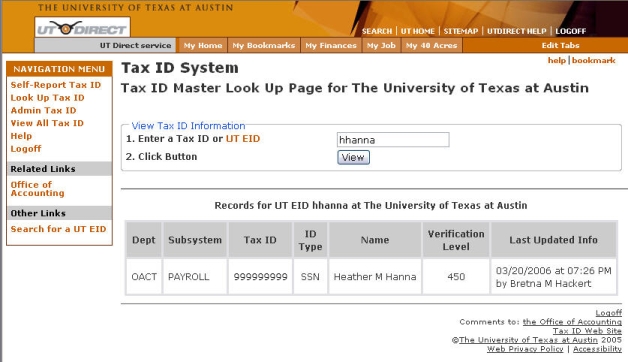

Master Look Up page

The Master Look Up page displays only the master record for a specified UT EID or Tax ID number. Authorized users can enter either the Tax ID number, UT EID, or UIN for an entity and click the View button.

Information for the master record for the UT EID, Tax ID or UIN will be displayed.

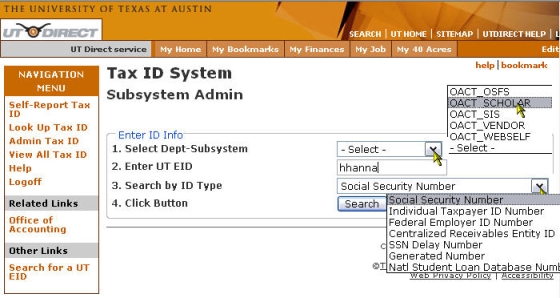

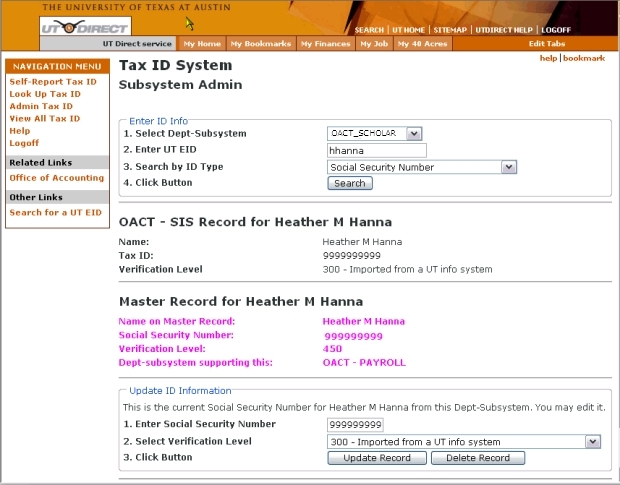

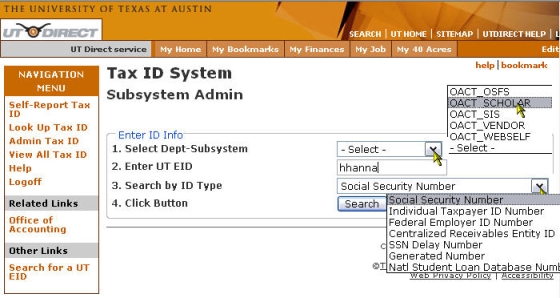

Subsystem Admin page

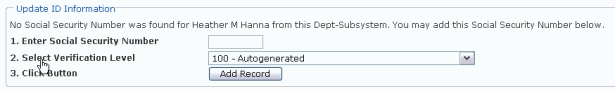

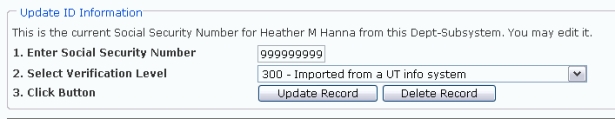

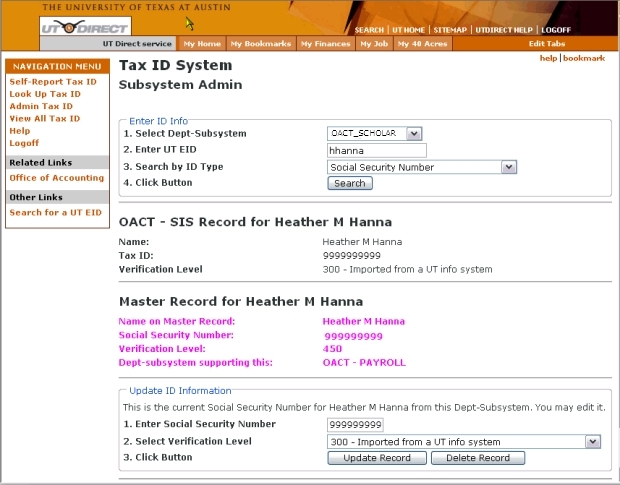

The Subsystem Admin page gives subsystem administrators the ability to update, add, and delete subsystem records. Authorized users must select a subsystem from the Dept-Subsystem pull-down menu, enter the entity's UT EID and select a Tax ID type from the ID Type pull-down menu and click the Search button to continue.

The subsystem and master record information will be displayed.

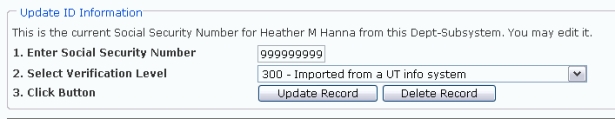

If a record exists in the subsystem for the identifier entered the Update ID Information section will appear.

- To update the Tax ID number, enter the new number in field 1 and click the Update Record button.

- To update the Verification Level, select a new level from the pull-down menu and click the Update Record button.

- To delete the record click the Delete Record button.

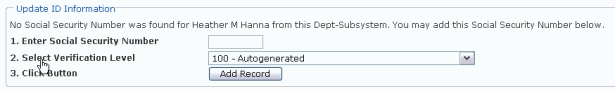

If a record does not exist in the subsystem for the identifier entered the Update ID Information section will appear; however the subsystem administrator will only have the option to add a record.

- To add the Tax ID number, enter the number in field 1.

- To add the Verification Level, select a level from the pull-down menu.

- Click the Add Record button.